CEO succession planning is climbing the agenda for employers, with 34% now prioritising it above AI adoption - prepare for leadership change and exits.

Published 8 November 2022 | 2 min read

Recently we have had several questions and queries through the HR Today helpdesk. As we approach the crazy Christmas rush, this is to be expected.

One topic that we have been fielding a lot of questions on is calculating holiday pay. Payroll and specifically calculating holiday pay can be an arduous task. Additionally, when we start to look at how to calculate holiday pay when an employee returns from either maternity leave, or a period of ACC leave. Please see below for the effects of parental leave and ACC leave on annual holidays.

Effects of Parental Leave on annual holidays

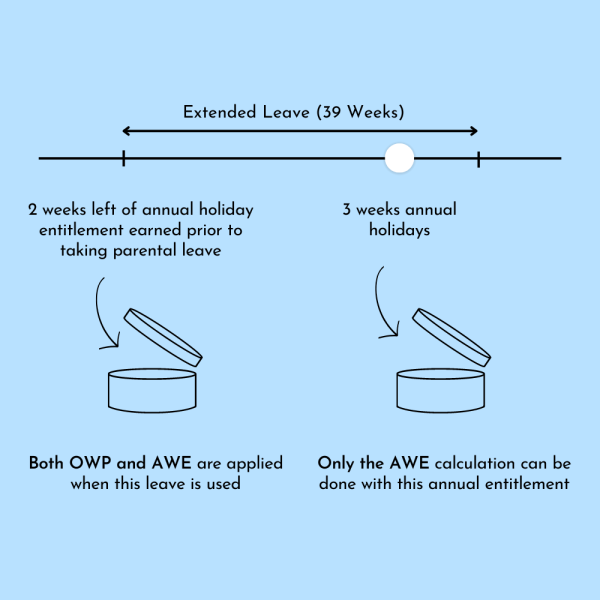

Under Section 16 of the Holidays Act 2003, parental leave is continuous employment, this means any staff on parental leave under this act will be accruing annual leave entitlement. This section excludes the use of ordinary weekly pay, so the calculation for holiday pay is based on average weekly earnings over a 12-month period.

Section 42 of the Parental Leave and Employment Protection Act stops the use of the ordinary weekly pay calculation for any annual leave entitlement earned while on parental leave or in the 12 months after returning to work. The only calculation that can be done is the average weekly earnings calculation (52 weeks). Annual Leave earned prior to going on parental leave is not affected.

So, an employee taking annual leave on their return to work (earned while they were off on parental leave) could be paid at a much lower rate than they would normally get.

Please see the example below on pre-parental leave annual leave payment and after return to parental leave annual leave payment:

Example: Annual Holiday entitlement earned before taking parental leave and not used

Any annual holiday entitlement earned prior to going on parental leave is not under the same rules, so both OWP and AWE apply.

Note:

There are two different types of annual holiday entitlement in this situation.

- Annual holiday entitlement under the Holidays Act that uses the greater of AWE and OWP, and

- Annual holiday entitlement earned on parental leave that only uses AWE.

In a payroll system to track and apply these correctly it is advisable to code them separately.

ACC

ACC and Parental Leave annual leave payments are different, please see below:

With ACC when annual holiday entitlement is taken it is still the greater of AWE and OWP and not just AWE that is used for annual holiday entitlement earned while on parental.

Being on ACC is counted as continuous employment and even on termination, any annual holidays entitlement to be paid out is based on the greater of AWE and OWP. AWE will be low but OWP is based on the agreed week (what is in the employees employment agreement so this could provide the weekly rate the employee would get if they were working).

If you have any questions or queries regarding payroll and how to calculate holiday pay, please don’t hesitate to give any of the HR Advisors a call. We are also lucky enough to have Tineke on our team who is a payroll expert.

Written by